Block #1: Why a Bitcoin Spot ETF is a Really Big Deal

Often the first word that comes time to mind when we think of Bitcoin’s price action is "volatility". That’s not by accident. Since Bitcoin’s inception in 2009, it has endured 3 brutal drops of over 60%. The first occurred in 2014, following the Mt. Gox debacle, which saw Bitcoin's price plummet by 61%. The second was in 2018, when the ICO mania lifted Bitcoin to a staggering $20,000, only to nosedive below $3,500. And the latest in 2021 as we saw BTC freefall 64% from $67,000 back down to the mid-$20,000s where it sits today.

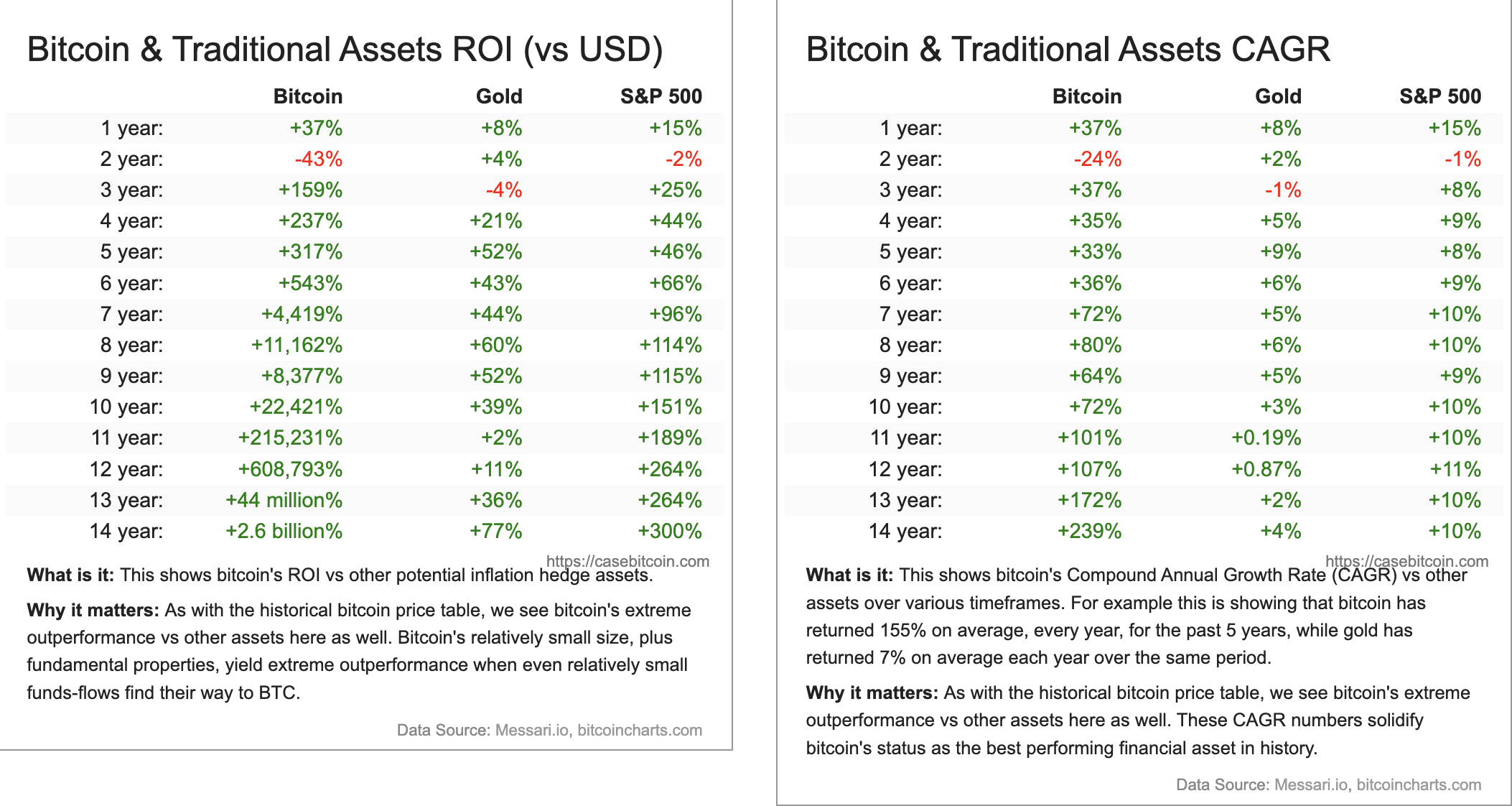

I lead with this because, despite the rollercoaster ride, BTC has outperformed the S&P 500 on the one-year, five-year, and ten-year chart. Thank you, Joe Kernon, for pointing that out on CNBC. But seriously, just look at the charts! So, perhaps our first association with Bitcoin shouldn't be "volatility" but rather "resilience."

Consider this: Bitcoin is still in its formative years. It's navigated these tumultuous waters without the backing of regulators. Most institutions have kept crypto at arm's length, often with more than just a 10-foot pole. But the tides are changing. Wall Street is rolling out the red carpet for Bitcoin, signaling a transformative shift in how we perceive, trade, and engage with this battle-tested asset. It's not just about resilience; it's about recognizing Bitcoin's enduring value in the financial landscape.

BTC ETFs on the Market Already + Explanation of Futures vs Spot ETF

Exchange-Traded Funds (ETFs) are powerful financial instruments that bundle together various securities, like stocks, to mirror the performance of a specific index. They offer investors a streamlined avenue to diversify their portfolios. Up until October, 11 ETFs were already providing exposure to Bitcoin through future contracts. On October 2nd, a new development came underway: nine more ETFs were greenlit, this time tethered to Ethereum via futures. This is not just news; it's a seismic shift.

Institutions are gearing up for their royal rumble.

The crescendo of anticipation is building around the potential approval of a Bitcoin Spot ETF. Why? Spot ETFs grant investors direct access to Bitcoin. Unlike futures ETFs, where you're essentially speculating on Bitcoin's future price without holding the actual asset, Spot ETFs offer tangible ownership. As we hold our breath, several Spot ETF applications are in the queue, with Blackrock's submission drawing significant attention. And here's a nugget to consider: Blackrock boasts a staggering 99.8% success rate with their ETF filings.

To truly grasp the transformative potential of a Spot ETF, let’s take a look at what it did for Gold.

Understanding the Impact of a Spot ETF - Gold

The first gold ETF, the SPDR Gold Trust ETF (GLD), was listed on the NYSE on November 15, 2004, and revolutionized gold trading by making it more accessible to a broader range of investors. After the approval and introduction of the first gold ETF, the price of gold soared nearly 350%, skyrocketing from around $450 to more than $1,820 in August 2011. To compare, Bitcoin currently sits at around $27,337. (At time of writing) If Bitcoin were to mirror that exact movement it would be resting at $123,015 by 2029.

The dramatic increase is associated with the ease of investment ETFs introduce. Previously, investing in gold was more cumbersome and limited to bars, coins, certificates, and shares of gold mining companies. This same ease of investment is the exact reason why so many institutions, retail investors, and crypto-enthusiasts are anticipating a breakout from crypto’s two year slumber. A Bitcoin Spot ETF would allow a more streamlined, secure, and accessible avenue for investing in Bitcoin, akin to how ETFs have made gold investment more appealing.

What This Means For Cryptocurrency

With the addition of a Bitcoin Spot ETF, companies have a much easier route to list it on their balance sheets, retail investors can interact with an exchange they are familiar with, and the overall accessibility and visibility of cryptocurrency in traditional financial markets will be significantly enhanced. Experts across the board are expecting this to have an immense positive impact. In an interview with Bloomberg, Steven McClurg, CIO of Valkyrie Investments, stated that Bitcoin could “10x” if it gets exposure from institutions. Mark Yusko, CIO of Morgan Creek Capital Management, believes Bitcoin will see inflows of up to $300 billion. Vetle Lunde, a seasoned analyst at K3 Research, believes Bitcoin will hit $42,000 within the first 100 days post-approval.

Needless to say, the anticipation for a Bitcoin Spot ETF approval couldn’t be greater. When a Bitcoin Spot ETF gets approved by the SEC, the market dynamics for Bitcoin and the crypto market as a whole will be fundamentally altered, potentially ushering in a new era of mainstream acceptance and unprecedented capital inflow into the cryptocurrency space.

Get ready. Bitcoin is about to be in everybody’s vocabulary once again.

More From Albert Rey Perez